The Nikkei 225 (??????, Nikkei heikin kabuka, ??225), more commonly called the Nikkei, the Nikkei index, or the Nikkei Stock Average (, , or ), is a stock market index for the Tokyo Stock Exchange (TSE). It has been calculated daily by the Nihon Keizai Shinbun (The Nikkei) newspaper since 1950. It is a price-weighted index, operating in the Japanese Yen (JP¥), and its components are reviewed once a year. Currently, the Nikkei is the most widely quoted average of Japanese equities, similar to the Dow Jones Industrial Average. Indeed, it was known as the 'Nikkei Dow Jones Stock Average' from 1975 to 1978.

The Nikkei 225 began to be calculated on 7 September 1950 (1950-09-07), retroactively calculated back to 16 May 1949. Since January 2010, the index is updated every 15 seconds during trading sessions.

The Nikkei 225 Futures, introduced at Singapore Exchange (SGX) in 1986, the Osaka Securities Exchange (OSE) in 1988, Chicago Mercantile Exchange (CME) in 1990, is now an internationally recognised futures index.

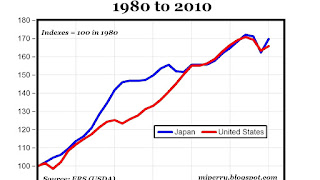

The Nikkei average has deviated sharply from the textbook model of stock averages, which grow at a steady exponential rate. The average hit its all-time high on 29 December 1989, during the peak of the Japanese asset price bubble, when it reached an intra-day high of 38,957.44, before closing at 38,915.87, having grown sixfold during the decade. Subsequently, it lost nearly all these gains, closing at 7,054.98 on 10 March 2009 -- 81.9% below its peak twenty years earlier.

Another major index for the Tokyo Stock Exchange is the Tokyo Stock Price Index (TOPIX).

On 15 March 2011, the second working day after the massive earthquake in the northeast part of Japan, the index dropped over 10% to finish at 8605.15, a loss of 1,015 points. The index continued to drop throughout 2011, eventually bottoming out at 8160.01 on 25 November, putting it at its lowest close since 10 March 2009. The Nikkei fell over 17% in 2011, finishing the year at 8455.35, its lowest year-end closing value in nearly thirty years, when the index finished at 8016.70 in 1982.

The Nikkei started 2013 near 10,600, hitting a peak of 15,942 in May. However, shortly afterward, it plunged by almost 10% before rebounding, making it the most volatile stock market index among the developed markets. By 2015, it has reached over 20,000 mark; marking a gain of over 10,000 in two years, making it one of the fastest growing stock market indexes in the world.

Maps, Directions, and Place Reviews

Weighting

The index is a price-weighted index. As of late 2014, the company with the largest influence on the index is Fast Retailing (TYO: 9983).

Annual returns

Components

As of February 2017, the Nikkei 225 consists of the following companies: (Japanese securities identification code in parentheses)

Source of the article : Wikipedia

EmoticonEmoticon